How are customs duties and VAT calculated for imported shipments?

When ordering goods from a non-EU country, import VAT is always charged, as well as customs duties (or tariffs) on goods valued over €150. It is advisable to check the current customs duty and VAT rates each time you intend to import expensive goods, as duty rates vary depending on the goods and the rates may also change. The EU duty rates can range from zero to 70% in special cases (e.g. bicycles from China), although the typical rate for consumer goods is between 0–10%, with lower rates for electronics (usually 0–3%) and slightly higher rates for textiles (e.g. T-shirts from China 12%). These rates can change almost overnight due to retaliatory tariffs, particularly those imposed on US goods.

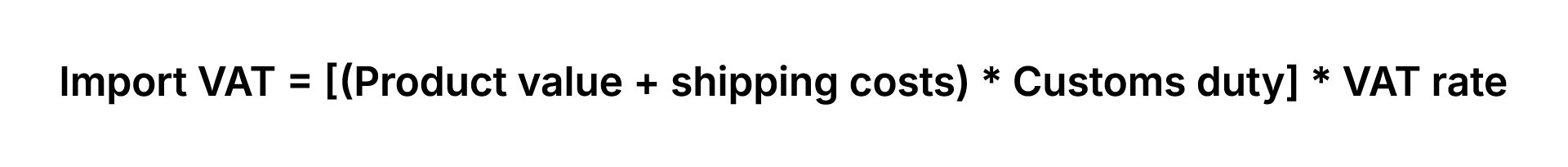

The value of the goods, including shipping costs, is the basis for determining customs duties and VAT. Customs duties are calculated based on the description of the goods and the country of their origin. The description is used to find the correct product code (also called HS code); only this code can be used to determine the applicable customs duty rate. To calculate the import VAT, you need to add shipping costs and customs duties to the value of the goods, and then multiply the total amount by the applicable VAT rate, as follows:

Therefore, where customs duties apply (e.g. goods valued over €150), it is impossible to determine the correct amount of VAT without knowing the relevant customs duty rate.

Seems complicated? Not anymore

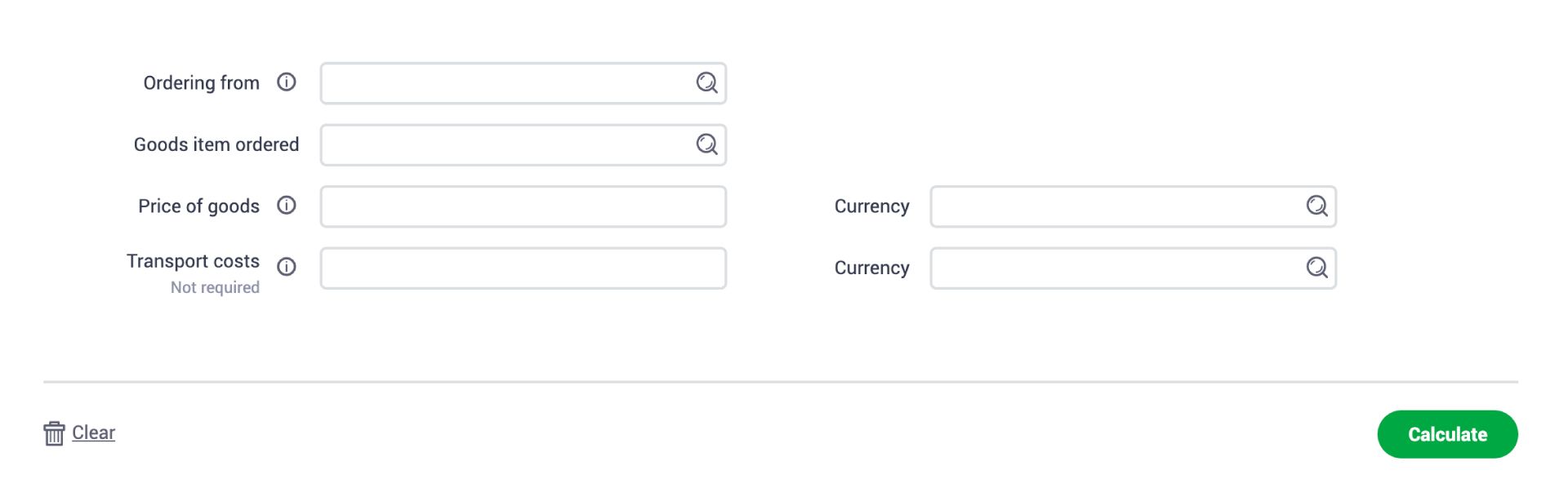

Above-described logic is used behind the Customs Duty Calculator, developed by Cybernetica for the Estonian Tax and Customs Board (ETCB) to enable e-shoppers to take advantage of simplified duty calculation. Now you can check the amount of duties and taxes to be paid before buying a product.

The Customs Duty Calculator is a simplified application that allows you to calculate the estimated amount of customs duties and VAT for the most popular items purchased online. The application is available to everyone on the ETCB website for free. The current version only calculates duties and taxes based on value, so it will not help in complex cases where special duties or restrictions apply (see advanced solutions below).

Note: Currently you only pay import duties if the goods do not origin from the EU and their value is above €150.

Low value goods may become subject to customs duties

If the value of goods does not exceed €150, they are not subject to duty as the de minims threshold still applies according to the Article 23 of Regulation (EC) 1186/2009/. However, discussions are underway in EU institutions about abolishing the €150 threshold and introducing special duty rates on low value goods . Special rates may vary depending on the type of the goods - this will become clear once the changes in EU legislation come into force. Then all goods from non-EU countries will always be subject to VAT and customs duties, regardless of the value of the goods.

As noted by the ETCB, the Customs Duty Calculator is intended for people who order goods from non-EU countries. It provides a list of the most frequently ordered products, such as electronics, clothing, cosmetics, toys etc. Users only need to select a product description, enter the price, shipping cost, country of origin and currency, and the duty amount will be calculated automatically. More information about the Customs Duty Calculator can be found here.

What happens if you don't find your item on the calculator?

No worries! You can search for customs duty rates using the product description or HS code in the much more sophisticated Master Tariff System application, also powered by Cybernetica, using a licenced product owned by Mærsk A/S. A light version designed for mobile devices is published on the ETCB web page. And the full version, which provides all the features also for professional users, is accessible on another ETCB web page.

All these solutions are based on the goods nomenclature – Harmonized Commodity Description and Coding System (HS) – developed by the World Customs Organization. And the corresponding EU nomenclature is integrated into the TARIC database that feeds information such as rate changes into the described national applications. All these operations are automated and run quietly in the background – this is possible thanks to the solutions created by Cybernetica software engineers.

Every customs administration needs a tariff information system – usually such systems are intended primarily for professional users. However, the calculation of customs duties can be made simple for everyone, by translating a complex coding system into common product descriptions and addressing typical use cases.

Want to know more?